Raviteja Govindaraju AMFI Certified Mutual Fund Distributor (ARN-150349), India

Want to invest in mutual funds? I can help!

Hello all, I want to share an important update — I’ve now got my license to sell mutual funds, which I would like to start doing as a side gig in my free time.

In this post, I will try to explain and answer the following questions.

Hello all, I want to share an important update — I’ve now got my license to sell mutual funds, which I would like to start doing as a side gig in my free time.

In this post, I will try to explain and answer the following questions.

- Why should you invest?

- Why should you invest in Mutual Funds?

- Why should you invest in Mutual Funds through a distributor?

- Why should you invest in Mutual Funds through a distributor like me?

If you want to jump into investing right away, download Assetplus app from this link and I would be automatically mapped as your advisor.

If you would like to get some knowledge before investing, let's start...

1. Why should you invest?

Reason #1: It’s very simple. If you don’t invest, you are losing money. If you just leave your money in your savings bank, you only get ~4% interest, which is taxable. So, effectively you end up getting around ~3.5% interest on your money. India’s inflation is hovering around ~7%, which means if you don’t invest, you are losing ~3.5% of your money every year.

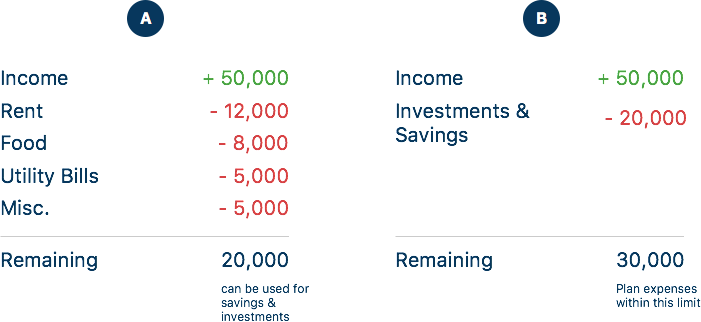

Reason #2: The first step to improve your financial health is to change your mindset from “Income (minus) Expenses = Savings” (Mindset A in the pic below) to “Income (minus) Savings = Expenses” (Mindset B). It means, you should give more importance to savings and investments than your expenses. i.e. Let’s say you get a salary of Rs.50,000 per month. Most people think of their monthly budget in this manner:

Reason #3: There is no other way to become rich. Jobs won’t make you rich. Stocks do. ESOPs do. Running a business may. What if you can’t or don’t have any of these?….

2. Why should you invest in Mutual Funds?

…You then invest in Mutual funds.

What are mutual funds?

Simply put, mutual funds are schemes where the fund takes in money from investors and invest in stock markets, or give it as loans to companies or government projects and so on to generate good returns. Each mutual fund scheme will have a manager who decides where your money will go. There are lots of varieties of mutual funds based on where you money will be invested in. There are equity funds that invest in stock markets. There are debt funds that invest in Government securities, bonds etc. There are hybrid funds that invest in a mix of equity and debt. Under equity, there is a lot of variety — Small Cap, Mid Cap, Large Cap, Index funds etc.

Over the years, equity asset class has always generated pretty good returns in the long run. Other than equity, people broadly invest in gold, real estate, fixed deposits, PPF, Insurance and the like.

Let’s compare equity with the other opportunities:

- Fixed deposits: Less return (~8%), No risk, Low liquidity

- Gold: Poor return, Low risk

- Real Estate: Good return, High risk, Poor liquidity, Needs heavy investments, Tax benefits

- PPF: Decent return (~7.9% compounded), Long lock-in period (15 years), Poor liquidity, No risk, Tax benefits

- Insurance: Common mistake by most people — Insurance is for insurance. Don’t treat it as an investment that would generate returns.

- Stocks: Highest risk, highest returns, High liquidity, Needs a lot of time and effort and sometimes luck

- Mutual Funds: Medium risk (low risk in the long run), Good returns, Good liquidity, Tax benefits.

So, comparatively, mutual funds are one of the best instruments to put your money in. Not just for the benefits you get, but by staying invested in mutual funds, you get a positive feeling that you are actually contributing to the country’s economy. Yes. The money you put in would be invested in stocks of listed companies which would then utilise the money in R&D, building new factories, launching new products, generating jobs etc. which ultimately would lead to better standards of living. Let’s not just be consumers of products. Let’s become a part of India’s growth story by investing in these companies, not directly (which is highly risky and takes a lot of time, effort and a bit of luck) but through mutual funds (less risky, no need to spend time and effort).

So, if you think about it, Mutual Funds should be the first in your investment portfolio and not the last!

You do not need to know all of the definitions and descriptions of this industry to invest because…

3. Why should you invest in Mutual Funds through a distributor?

…Every field has professionals. Likewise, Mutual Fund distributors are professionals involved in understand client’s current and future financial status, their risk profile, their family status, future expenses and 100 other factors that might impact your financial health and suggest the most suitable products for the client.

Mutual Fund schemes also offer direct plans where you can bypass the distributor and buy directly. There are pros and cons of doing this.

Pros:

- Since returns in direct plans exclude the brokerage commissions, you will end up getting slightly higher returns in the very long run.

Cons:

- There are over 2000 schemes. Choosing which one to pick would be a very challenging task if you do not have proper idea of this industry.

- You may think you can just go ahead and invest in 3 of the top performing mutual funds. What you won’t study is their expense ratio, risk potential etc. among others and may end up taking bad decisions.

- The other common mistake I’ve seen people investing in direct plans is that they sometimes get too excited and invest in 20–40 funds which is not only unnecessary but gets very difficult to track.

- If a fund doesn’t perform well, you may immediately redeem it, not observing the effect of the exit loads and/or short term / long term capital gains.

Why do you have to worry so much and take headache when you can rely on a distributor who knows this subject well and can handle everything for you? You are not paying the distributor anything from your pocket. So, if you want to invest in mutual funds but have little/no idea about this, please go with a distributor instead of playing around with your hard-earned money.

Ok, if you have read until here, you might now be feeling the need to invest in mutual funds right away. Well, there are 100s of distributors in every city. Why should you choose me?…

4. Why should you invest in Mutual Funds through a distributor like me?

…Because I am like you. Yes, I am not from a finance background.

Let me tell you why most people don’t like distributors… They think that the distributor will only sell schemes where he would get higher commissions and not the schemes which are most suitable for them. This is one reason why most distributors won’t tell you about direct plans. And guess what, I’ve already told you about them in the previous section and asked you to weigh the pros and cons and decide for yourself.

I have a day job and I am doing this as a side gig. So, I am not too concerned about the money I make in this. My prime motto of doing this is — one, sheer passion in stocks and mutual funds and two, I want to improve the financial literacy of people. There is so much you can do with your money which a lot of people are unaware of and I would like to play my part in educating and helping people invest in mutual funds. You therefore won’t face any conflict of interest in my case. I also wouldn’t confuse you with financial jargon. I can explain you things in very simple terms. I will be easily approachable and we can enjoy good conversations over coffee on this topic. You will find a friendly and helpful advisor in me and not a salesman selling you products with high commissions.

And oh, by the way, I am not putting any fake testimonials to get leads. I have just started this business and would love getting feedback from my clients after a few days.

Mutual fund investments are subject to market risks. Please read the offer document carefully before investing.

If you have read it this far, I hope you understand the importance of investing. I am an AMFI Certified Mutual Fund Distributor with ARN-150349 and I got empanelled with Fundsindia and Assetplus to run this business.

Assetplus is a mobile app based platform for mutual fund investments which makes the process very simple and straightforward. Please download the app from this link and check it out for yourself. When you download from this link, I will be automatically mapped as your advisor and you can seek out for any kind of help on which funds to invest, when to invest, what mode of investment is preferred etc.

If you are still not convinced or have more questions, leave your details in the form below and I'll get back to you at the earliest.